Slower demand and an increase in the supply of homes for sale indicates the Metro Vancouver real estate market is entering a new cycle, according to the Real Estate Board of Greater Vancouver (REBGV).

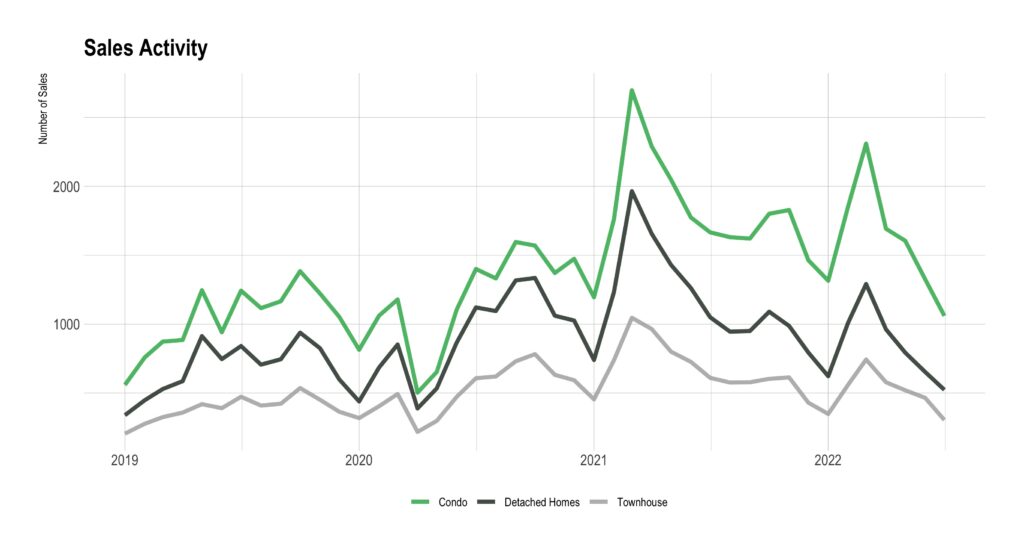

New data shows property sales fell 22.8% in July compared to June and were 35.2% below the 10-year historical average for the month.

“Home buyers are exercising more caution in today’s market in response to rising interest rates and inflationary concerns,” said REBGV chair Daniel John. “This allowed the selection of homes for sale to increase and prices to edge down in the region over the last three months.”

What do the new market dynamics mean for the typical home buyer?

Clark Woods LLP real estate and conveyance lawyer Keith Barron says that while rates are causing a drop in home sales compared to previous months, the average property value is still up significantly from even a few years ago.

“Changing interest rates may give you more to consider in terms of how you finance your property,” he said, “but home ownership is still a strong investment in the long term.

Barron added that with the changing real estate market, more homeowners are looking at either locking in rates or exploring options for pre-payment to bring down the principal balance before they renew their mortgage.

While sales are slowing, prices may not be quick to follow.

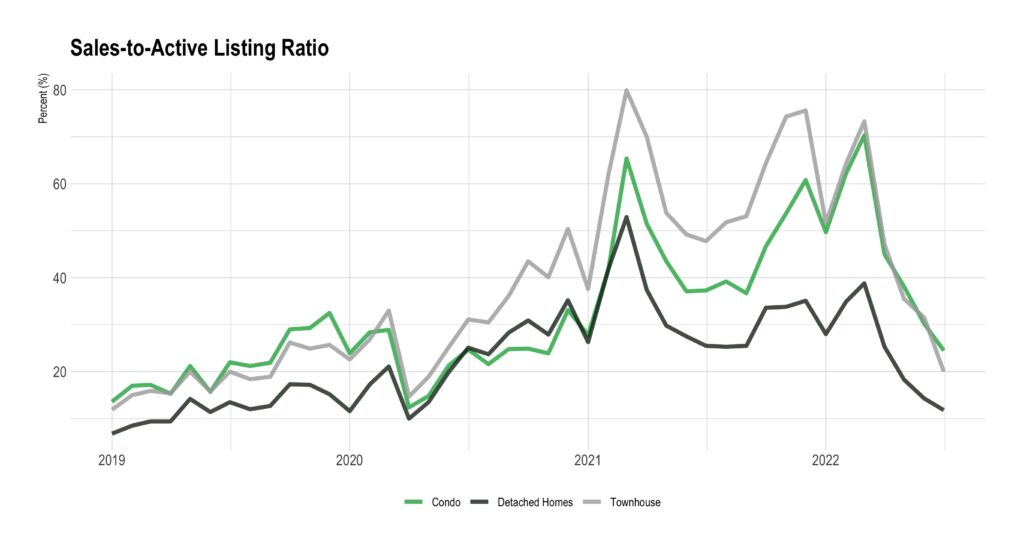

The sales-to-active listings ratio for July was 18.3% for all property types. According to the REBGV, downward price pressure tends to occur when the ratio dips below 12% for a sustained period, “while home prices often experience upward pressure when it surpasses 20% over several months.”

Are you looking to buy or sell a home? The legal experts at Clark Woods LLP are happy to assist with your real estate and conveyance needs. Call 604-330-1777 today to setup a consultation or visit our real estate page for more information.